BRICS v. Dollars

I examine the prospects and possibility of the BRICS nations led by China displacing the United States Dollar as the world reserve currency and dominant currency of world commerce

In the past few weeks, talk of “de-dollarization” - once talk mainly relegated to hard money circles - entered mainstream discourse with the appearance of the CNN video clip below by Farheed Zakaria.

The dominant position of the United States Dollar as the world’s reserve currency since the end of the Second World War has afforded the United States Federal government great benefits which are virtually unparalleled and which have massively boosted its power projection abilities both at home and abroad.

With this arrangement, the United States government can run perpetual jaw-dropping budget deficits - with some of its members even boasting about how “deficits don’t matter” - without triggering hyperinflation or rising interest. This is all done while maintaining fiscal health standing worse than nations like Argentina and Greece whose economic prospects have been stunted in no small part by poor fiscal management for decades.

As can be seen in the graph above, based on fiscal health data compiled from the Heritage Foundations Economic Freedom Report for 2023, the United States always performs very poorly in this metric of the Economic Freedom Report. This invariably always weighs down the overall economic freedom score of the United States.

The United States can escape the repercussions of poor fiscal management because since the Dollar is the world’s reserve currency, a massive global market exists to buy up Dollars, which nations like Argentina and Greece lack. Thus, foreigners subsidize American consumption and the bulk of newly produced Dollars leave the United States.

The United States, reached this point of monetary privilege, due to the fact that long before the Dollar became the worlds reserve currency, carrying the Dollar was as good as carrying gold, the United States government was far more fiscally prudent because it spent a far smaller share of national output and balanced its budgets, and the United States offered institutions which kept arbitrary state power limited while private property and contract rights were widely respected.

To this day, one of the factors which still helps in maintaining the Dollars position as the worlds reserve currency - apart from the Federal Reserves' relative hawkishness vis-a-vis other fiat currencies out there like that of the BRICS nations1 2 3 4- is the fact that the United States still offers solid institutions which respect property and contract rights along with open markets.

It’s on these measures, that I believe that even though a lot of room exists for worry about the state of the Dollar - especially in light of 40-year high inflation - the BRICS nations probably don’t have a chance of supplanting the Dollar as the worlds reserve currency anytime soon.

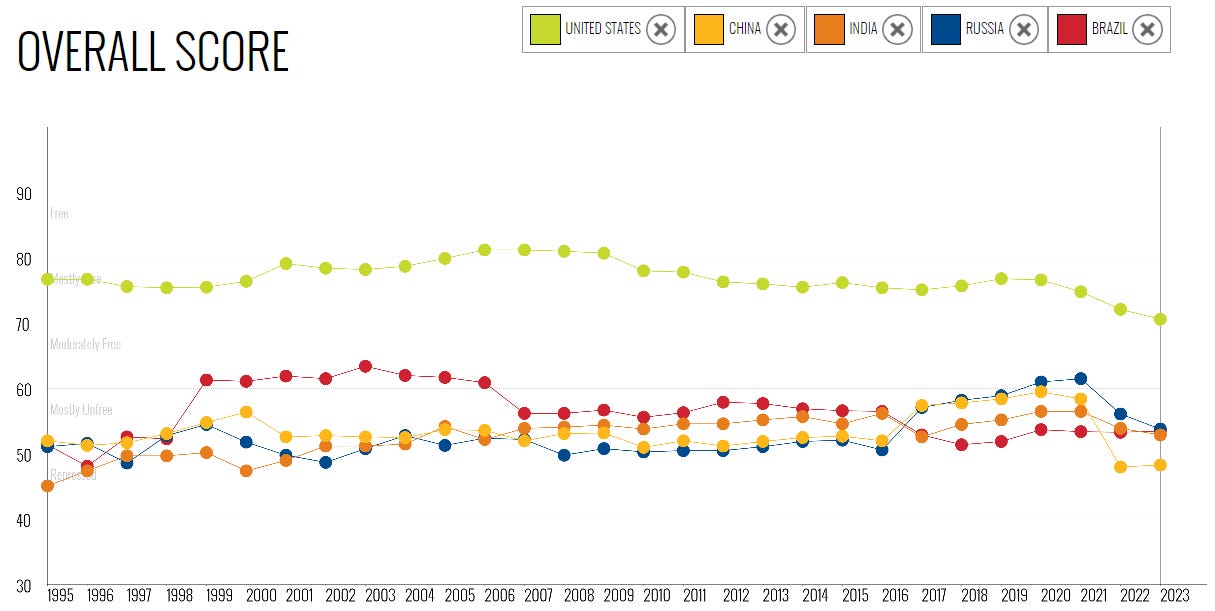

As can be seen in the graph above, when using the economic freedom index data from the Heritage Foundation which measures overall economic freedom, the United States quite significantly scores higher than any of the BRICS nations, and its still largely in the free category even though its position has deteriorated since the beginning of the millennium.

In the Index of Economic Freedom by the Heritage Foundation, the metrics which capture the quality of institutions are measured by the “Rule of Law” and “Open Markets” components of the overall economic freedom score.

The Rule of Law component is made up of Property Rights, Judicial Effectiveness, and Government Integrity.

Virtually all BRICS countries score very poorly on the Property Rights metric while the United States has an almost perfect score. As experience and evidence have shown, property rights (and investment security) are indispensable prerequisites for economic growth and development5. Individuals will not invest or accumulate capital if they feel that it can be expropriated or they will not be able to keep the fruits of their labor. Furthermore, the stronger property rights protections are, the high GDP per capita tends to be. In the context of the Dollars and a BRICS reserve currency, holders have a lower probability of capital expropriation in the United States financial system. Knowing this, this drives a demand for United States government treasuries - which invariably subsidizes the fiscal profligacy of the United States government.

The ability to resolve disputes, enforce contracts, apply fixed and certain rules which everyone can abide by, and to do so in a manner that is free from political interference is key for smoothly functioning markets. Also on this score, the United States does better than BRICS nations. Even though the judicial nomination process in the United States is increasingly politicized, judicial independence is still intact.

As can be seen above, the United States significantly outscores the BRICS nations on the Government Integrity metric. Where people invest or accumulate capital in no small part is dictated by government integrity. In places, where it’s felt that government power is too arbitrary and the enforcement of rules is uneven, investment tends to stay away. In the context of a reserve currency, investors will tend to keep away from financial systems where for example, the head of the central bank is involved in partisan politics or where it’s perceived that the central bank lacks independence.

The Open Markets component is made up of Trade Freedom, Investment Freedom, and Financial Freedom.

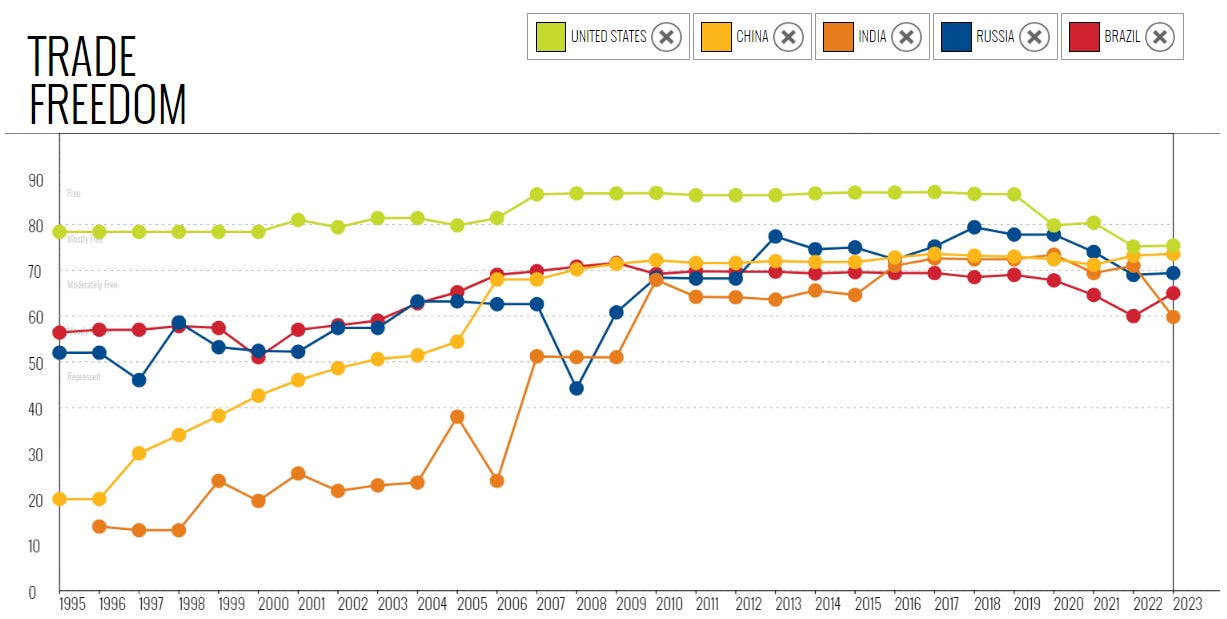

On the Trade Freedom score, the score of the United States is almost indistinguishable from that of the BRICS nations. As we can be seen on the graph, these nations have worked in the past few decades to increase trade freedom and to integrate themselves into the international division of labor. In small part has the economic growth and development which his bloc has seen in the past few decades come from trading more with the rest of the world by making themselves low-cost manufacturing hubs.

On the Investment Freedom front, there is a gap between the BRICS nations and the United States. With investment freedom, people are free to invest in what they please to invest in and nations have open capital accounts that allow capital to move freely into and out of their financial systems. If one takes a country like China, which scores the poorest in the BRICS nations, China has capital controls and a very protectionist financial system. But if the Chinese Yuan will ever displace the US Dollar as the world’s reserve currency, China will by definition have to open up its capital accounts, float the Yuan, and would have to end all capital controls. Such a move would mean that China moves even further in the direction of a market economy and less state control. Such will come in conflict with the Chinese Communist Party (CCP).

On the Financial Freedom front, there still is a gap between the United States and the BRICS nations. With financial freedom, individuals and businesses have the freedom6 to use whatever financial products they choose to use with minimal interference from the state. On this score, China7 scores very poorly because China has capital controls, cracks down heavily on the cryptocurrency industry, has a double-tracked currency system, and even a double-tracked capital market system as part of its financial protectionism.

Conclusion

From the case I laid out above - though not comprehensive - it’s safe to say that in the short run, the BRICS nations will not displace the United States Dollar as the world’s global reserve currency. But as Americans, such talk should be a cause for concern that should not be taken lightly or brushed aside.

Practical steps in the short run which can prevent this from ever happening include curbing budget deficits and putting the United States government on a healthier fiscal footing by fundamentally changing the budgetary rules of the United States government with something like a Swiss-style spending cap89, bringing down our 40-year high inflation as soon as possible, strengthening the quality of American institutions and renewing them where needed, and removing all taxes from cryptocurrencies and precious metals.

But in the long run, the biggest step that could be taken is getting the United States back on some metallic standard and/or figuring out how to separate money production from political control.

In the first instance - long before Bretton Woods - the United States Dollar built the trust and respect of the world because political influence over it was limited while such is being eroded and could be lost because of increasing political influence over it.

I asked ChatGPT what the average inflation rate in the BRICS countries has been since 1980 and using World Bank data, the figure it gave me was 225.24% per year

I also asked ChatGPT what the average inflation rate in the United States has been since 1980 and using US Bureau of Labor Statistics data, the figure it gave me was 2.62% per year.

I asked ChatGPT what the average money supply growth rate in the BRICS countries has been since 1980 and using World Bank data, the figure it gave me was 115.04% per year.

I also asked ChatGPT what the average money supply growth rate in the United States has been since 1980 and using Federal Reserve Bank of St. Louis data, the figure it gave me was 6.22% per year for the M2 money supply.

In fact, the economic rise of China in the past 3-4 decades can be interpreted as increasing respect for property rights within what otherwise is a nominally communist country.

Yes, I know that legal tender laws are a thing and taxes still exist on cryptocurrencies and precious metals. But on a relative basis, which is what this index measures, Americans still enjoy more financial freedom

Which has the Yuan and whose currency is the possible best candidate to displace the United States Dollar

A balanced budget amendment is not needed to restore fiscal sanity as such would take decades to constitutionally ratify. Instead, a hard spending cap and rule can be passed by Congress and is a better alternative to the now decades-old balanced budget amendment grift.

Daniel J. Mitchell has written a lot about this at length: https://danieljmitchell.wordpress.com/2012/04/26/switzerlands-debt-brake-is-a-role-model-for-spending-control-and-fiscal-restraint/